New Customer? Create an account to use our services. It is FREE & under NO OBLIGATION.

Employee Credit Check Questions

EC1. What information does the Employee Credit Check provide?

The Employee Credit Check is a UK financial check and provides information on:

-

- County Court Judgment (CCJ) Records or Scottish equivalent

- Bankruptcy / Individual Voluntary Arrangement (IVA) Records or Scottish equivalent

- Correction Orders / Disputes

- Financial Data (number of active accounts & loans held by the individual)

- Electoral Roll Registration History

- Residence Confirmation

- Relocation Data

- DOB Verification

- Mortality Data

- Alias Data

- a Result accompanied by a Score which categorises the Credit Check as “Clear” or “Alert”

Note: Our Credit Check does not affect your candidate’s credit score.

EC2. Does an Employee Credit check affect my candidate’s credit score?

No, our employee credit check does not affect your candidate's credit score.

Our employee credit check is a "soft search" which leaves a "soft footprint" on your candidate's credit report.

This is a legal requirement and is only visible to the candidate. Only the candidate can see them on their own report and it doesn’t matter how many there are.

A soft search cannot seen by any other companies or lenders so they have no impact on the candidate's credit score or any future credit applications they might make.

EC3. Can we (the employer) see details of the candidate’s credit accounts, payments and outstanding balances?

No, this type of information is not available for the purpose of employment screening.

Our Employee Credit Check will check and provide information on the following:

- County Court Judgment (CCJ) Records or Scottish equivalent

- Bankruptcy / Individual Voluntary Arrangement Records or Scottish equivalent

- Correction Orders / Disputes

- Financial Data (number of active accounts & loans held by the individual)

- Electoral Roll Registration History

- Residence Confirmation

- Relocation Data

- DOB Verification

- Mortality Data

- Alias Data

- a Result accompanied by a score which categorises the Credit Check as “Clear” or “Alert”

EC4. My candidate says he/she is registered on the electoral register but the report say they are not?

If your candidate has registered to vote and their credit report does not show this, please advise them to contact the credit reference agencies that we use to run the search.

- Experian: https://ins.experian.co.uk/contact

- Equifax: https://www.equifax.co.uk/Contact-us/Contact_Us_Personal_Solutions.html

Please note that registration for the Electoral Roll is conducted in August each year, but our register may not be updated until the end of April in the following year.

If your candidate has not registered to vote, they may want to contact their local authority about filling in an electoral registration form.

If your candidate moves home they can tell their local authority who will tell credit reference agencies about their change of registration in the course of the year.

EC5. My candidate claims the report is inaccurate what should they do?

The Electoral Roll.

Please see EC4 above.

County Court Judgments (CCJ):

If your candidate believes a county court judgment has been recorded incorrectly, they should contact the county court, quoting the case number included on their report.

If the judgment was recorded incorrectly the county court will alter their records.

Credit reference agencies are told about any such changes within four weeks, but if your candidate can give the credit reference agencies original court documents, in the form of a Certificate of Satisfaction or Cancellation, they may be able to change their records sooner.

Scottish Decree:

If your candidate has paid a Scottish Decree, they should send The Registry Trust (address below) a receipt or a letter from their creditor (known as the pursuer) to confirm their payment.

Alternatively, your candidate can write to The Registry Trust Ltd questioning the accuracy of a judgment recorded on their report, asking for an entry to be changed.

Once The Registry Trust Ltd has amended their records, they will then tell the credit reference agencies about any change to your candidate's report.

Please note: The Registry Trust Ltd will charge a fee. We recommend your candidate contacts the Registry Trust Ltd to confirm the fee amount.

Address: Registry Trust Ltd, 173-175 Cleveland Street, London W1P 5PE.

Northern Ireland Judgments:

For judgments made in Northern Ireland; if your candidate provides documents from a plaintiff to confirm a payment, the agencies will change their records.

If your candidate has any questions about the accuracy of a judgment recorded on their report, they need to contact the court concerned.

Bankruptcies:

If a bankruptcy order against your candidate is annulled (cancelled) or discharged (that is, they have met all terms), your candidate should send a copy of the Annulment Certificate or Order of Discharge to the credit reference agencies we use to run the search.

These are:

- Experian: https://ins.experian.co.uk/contact

- Equifax: https://www.equifax.co.uk/Contact-us/Contact_Us_Personal_Solutions.html

They will then update their records.

If your candidate's bankruptcy has been annulled, they should completely remove any record of it from their report.

If your candidate's bankruptcy has been discharged a record of it will be kept on your report but it will show that it has been discharged.

Voluntary Arrangements (IVA):

If your candidate has any questions about a record of a voluntary arrangement they should contact the supervisor who dealt with their case and ask them for a document that confirms that the information on their report needs to be changed. They then need to send this document to Experian and Equifax so they can change their records:

- Experian: https://ins.experian.co.uk/contact

- Equifax: https://www.equifax.co.uk/Contact-us/Contact_Us_Personal_Solutions.html

Aliases:

If there are any names shown on your candidate's credit report that they have never used, they should contact Experian and Equifax and they will investigate the matter and make any necessary changes to your candidate's report.

- Experian: https://ins.experian.co.uk/contact

- Equifax: https://www.equifax.co.uk/Contact-us/Contact_Us_Personal_Solutions.html

Other Information

If your candidate believes any other information returned on the employee credit check is inaccurate they can contact Experian and Equifax for advice on how to amend it.

EC6. Can you explain the credit check report?

The Credit Check report will include:

- The original request information you supplied, e.g. name, address etc.

- Outcome - The outcome will be either “Clear” or “Alert”.

- Score - Based on the number of matches and mismatches of data the system calculates a score for the individual. A score of 20 or more will generally result in a “Clear” outcome. A score of 19 or less will result in a “Alert” outcome. The higher the score, the better financial status of the individual. See: EC9

- Result fields:The result fields show the results for searches against several databases:

- Address Verification – draws on electoral roll(full and edited), financial data (credit files), the LexisNexis database, and the telephone directory.

- Identity Verification – draws on electoral roll, financial data and the Births Index, which now covers most UK-born individuals.

- Financial Data Verification – draws on financial data: "InsightAccounts/Lenders" are the number of active accounts/loans held by the individual which are linked to the address provided or DOB.

- Insolvency/CCJ - checks County Court Judgment (CCJ) Records or Scottish equivalent Bankruptcy/Individual Voluntary Arrangement (IVA) Records or Scottish equivalent, Correction Orders / Disputes

- Mortality – checks all mortality registers

It is possible for a lack of match against the first two categories to be compensated for by matches elsewhere.

For example, if someone is not yet on the electoral register, verification of their address may come from their Financial Data, such as mortgage data.

EC7. We (the employer) are not a Financial Services organisation, can we still obtain Employee Credit checks?

Yes, employee credit checks are not exclusive to the financial services sector, however, it is important to note that an Employee Credit Check should only be obtained if it is relevant to a candidate’s job or work role

For many relevant roles, a ‘financial soundness’ check can help you assess the integrity and good character of a candidate.

Your Organisation has valuable assets, stock and equipment, intellectual property, customer data, which you cannot risk being compromised, stolen or sold to fraudsters or competitors.

By including data from Employee Credit Checks in your risk assessment of each employee this will enable better recruitment decision’s so the likelihood of such situations can be prevented or greatly reduced.

EC8. The Employee Credit Check uncovered that my candidate has a County Court Judgement, what should we do?

Talk to your candidate about the circumstances that led to the court judgment.

For some individuals there will have been mitigating circumstances such as losing their job, serious illness or family problems and others may be able to demonstrate steps they have taken to avoid further judgments in the future.

This additional information will enable you to make a suitability decision regarding your candidate.

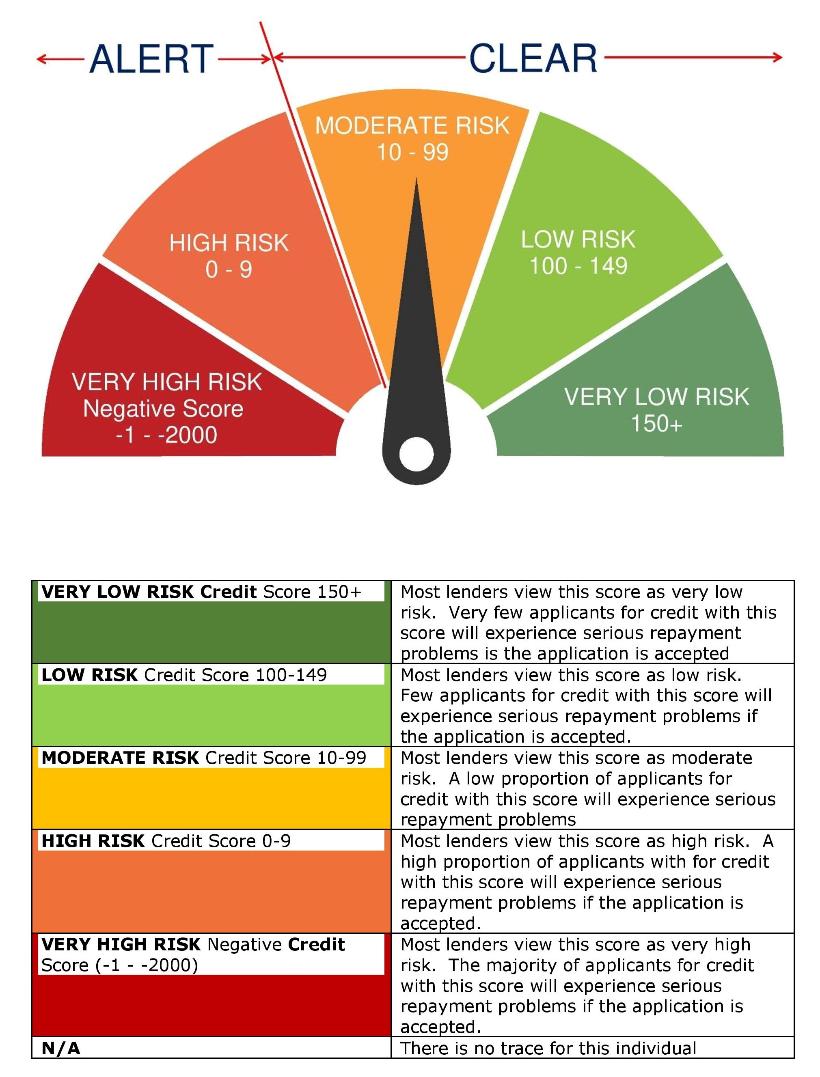

EC9. What Does the Result and the Score mean?

There isn’t a single, universal credit result or score.

Our employee credit check will categorise the candidate’s credit check as “CLEAR” or “ALERT”.

This gives you an instant overview of their financial situation. This is a guide to help you make a suitability decision. It is not indicative of creditworthiness.

Further guidance on what to do if the result is an Alert is provided in EC10 below.

Our employee credit check also provides a score.

Based on the number of matches and mismatches of data the system calculates a score for the individual. A score of 20 or more will generally result in a “Clear” outcome. A score of 19 or less will result in a “Alert” outcome. The higher the score, the better financial status of the individual.

The Result and the Score can be a useful guide and gives you an idea of the financial status of an individual, so you can make more informed choices when it comes to their suitability for employment

***Note: This information does not constitute financial advice. You use the information at your own risk and we can't accept liability if things go wrong. Always do your own research on top to ensure it's right for your specific circumstances

EC10. What to do if the outcome is Alert?

The first step is to double-check that the information is correct – for example, check the spelling of the name or the address details. If incorrect information was entered on the search you should order a new search with correct data.

Based on the number of matches and mismatches of data the system calculates a score for the individual. A score of 20 or more will generally result in a “Clear” outcome. A score of 19 or less will result in a “Alert” outcome. The higher the score, the better financial status of the individual.

The following will trigger inevitable alerts, with the point deduction shown in brackets:

- Mortality match on name, postcode and date of birth (-1000)

- Very strong Departure Indication (-2001)

- Adverse credit data (Bankruptcies, CCJs, IVAs, or Scottish equivalents) (-1000).

Note: adverse credit data is specific to address provided plus name entered plus date of birth. If these details are incorrect the report will not show adverse data because their will be no match to the the name/address/DOB provided.

Also, adverse credit data is not carried on to subsequent addresses.

If the address was not verified, check that the address provided was complete and correct. If the addres sprovided was correct, the most common reason for non-verification of an the address is a very recent move to the address. It is possible for electoral records to lag behind by a few months (note: council tax registration does not imply electoral registration). Also consider that the individual may not currently reside at this address.

If the address or identity could not be verified you should validate the address and/or identity of your candidate by documentary means.

Then make sure that there are no flags for matches on the Mortality or Departure Register

The Credit Check report can be a useful guide and gives you an idea of the financial status of an individual, so you can make more informed choices when it comes to their suitability for employment. If you obtained a new search and the result is still an Alert, use it as a guide to assess the suitability for employment, in line with your Company's own Policy and Risk Assessments.

NOTE: The Credit Check leaves only a “soft footprint” on the customer’s record which means it will have no impact on their credit worthiness when assessed by, for example, a lender. Whilst our service does access information held concerning the accounts which the individual holds with financial institutions, this is merely to help validate the customer’s name, age and residence address. This Credit Check will not affect credit rating.

***Note: This information does not constitute financial advice. You use the information at your own risk and we can't accept liability if things go wrong. Always do your own research on top to ensure it's right for your specific circumstances

Testimonials

We are proud to be recommended by many of our customers. Check out our Customer Feedback here.

www.dbsapplication.co.uk www.dbsdirect.co.uk www.basicpolicecheck.co.uk

Privacy Policy - Terms of Business - Disclaimer - About Us - Contact Us

Online DBS Checks, AccessNI Checks, PVG Checks, Basic Disclosure Checks, External ID Validation, Employee & CompanyCredit Checks